Tennessee legislature serves up a host of new alcohol laws in 2018

Sunday sales of alcohol at retail liquor stores and groceries stores stole the spotlight in the 2018 Tennessee legislative session.

For industry insiders, however, the biggest news in 2018 so far has not been legislative. Ask anyone that has done a liquor license renewal in the ABC’s new online system, RLPS. It is a memorable experience, to say the least. (In case you have been living under a rock, all new liquor license applications and renewals in Tennessee must be filed on-line through RLPS.)

Without further ado, here are the highlights from the 2018 Tennessee legislative session.

Sunday and Holiday Sales. P.C. 783 legalized the sale of beer, wine and spirits at retail liquor stores starting April 22. Sales of wine at food stores start on Sunday, January 6, 2019.

In addition, P.C. 783 – available at this link – legalized the sale of beer, wine and spirits on New Year’s Day, Memorial Day, Fourth of July and Labor Day. Retail liquor stores must be closed and food stores cannot sell wine on Easter, Thanksgiving or Christmas.

Some legislators had quite a scare when they discovered that P.C. 783 actually authorized the sale of wine in food stores on Easter, Thanksgiving and Christmas. Following a plethora of speeches about the evils of alcohol and the virtues of attending church service on religious holidays, they found redemption and banned the sale of wine on Easter, Thanksgiving and Christmas in a late amendment to P.C. 1010.

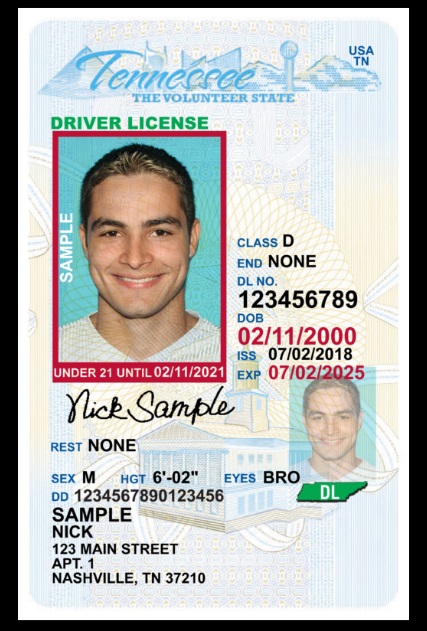

Vertical Driver’s License. Tennessee became the 48th state to enact a vertical driver’s license for drivers under the age of 21.

Tennessee started issuing vertical licenses on July 1.

The vertical license does not expire when the driver turns 21, which continues a long-standing problem with under-21 driver’s licenses in Tennessee. Read more at our blog.

Open Carry. We predict that new “open carry” law in P.C. 755 will be the sleeper hit of 2018 among industry insiders. Open carry allows beer and alcoholic beverages to be carried by patrons between different licensed premises, provided they are connected. Open carry also paves the way for multiple restaurants to share a common dining space, such a food court. The law even allows restaurants to open a free-standing bar in a common area, like a food hall. Read more here.

P.C. 755 also gives the Tennessee ABC more discretion concerning barriers in outdoor areas. For decades, the ABC has consistently required fencing or similar barriers to surround outdoor dining areas. As of press time, the ABC has not issued any guidance concerning what type of barrier will work for a “reasonable efforts to ensure that a customer cannot leave the premises with an alcoholic beverage or beer…” Stay tuned to Last Call for more details.

Samples. For decades, Tennessee law has prohibited on-premises retailer’s such as restaurants and hotels from giving away wine and spirits. Section 2 of P.C. 755 allows a licensee to serve a sample of wine – up to one ounce. Hotels are authorized to “provision” up to four 750 milliliter-or-smaller sealed bottles of wine or spirits. Although not entirely clear, we believe that the legislation limits hotels to giving away wine or spirits, as part of the room rental. We do not read P.C. 755 as authorizing hotels to sell wine and spirits by the bottle.

New Handgun Sign. Beginning January 1, 2018, a 2017 amendment to T.C.A. § 39-17-1359 set a new standard for signage required to prohibit patrons from carrying firearms onto a premises that has a liquor license. The universal “no handgun” sign is no longer valid in Tennessee.

In order to prohibit patrons from carrying handguns, restaurants, hotels, and other license holders must post new larger signs that state “NO FIREARMS ALLOWED” in letters that are at least 1” high and 8” wide. The new law also requires that the sign state “As authorized by T.C.A. § 39-17-1359.” And if that’s not enough, the sign also has to include the universal “no handgun” sign, inside a circle at least 4” in diameter.

Here is a sample.

Keep in mind that law enforcement officers may still carry firearms, regardless of sign postings.

We see the new law as either a favor for some legislator’s friend that makes handgun signs, or, more likely, a way to make it more difficult and less appealing to prohibit carrying firearms where alcoholic beverages are consumed on-premises.

Fresh Start Act. P.C. 793 paves the way for some convicted criminals to own establishments with liquor licenses. Previously, Tennessee law was clear: Persons convicted of a felony or a crime involving the sale, transportation or manufacture of alcoholic beverages could not own an establishment that holds a liquor license, if convicted within eight years of the date of the application.

The Fresh Start Act muddies the waters and sets forth criteria to consider when denying an application or refusing a renewal based on a criminal conviction. Kuddos to Tennessee ABC Director Clay Byrd and staff for promptly issuing guidelines for the Fresh Start Act process. Here is a copy of the memo.

LBD Tax Notice

In response to recent legislation, the Tennessee Department of Revenue issued a tax notice in February that clarifies that drink taxes can be included in menu prices or listed on the final bill. The law now gives taxpayers the option to decide whether liquor by the drink in sales taxes should be listed on menus, or on the final bill presented to the customer. Read more at our blog.

Retail Liquor Store Moratorium. As part of the legislative tradeoff for allowing Sunday and holiday sales of wine in food stores, the Legislature imposed a moratorium on the issuance of new retail off-premises liquor licenses. The Tennessee ABC is no longer issuing new retail liquor licenses. An applicant must either purchase an existing store or wait until the moratorium expires on July 1, 2021.

P.C. 783 sets up a process to transfer liquor licenses if a purchaser would like to move the location of the liquor store. The new location cannot be within 1,500 feet of an existing retail liquor store and must be inside the same city or county.

The moratorium requires that all Certificates of Compliance for a transfer of location contain specific language stating that no other liquor store is located within 1,500 feet.

The moratorium may lead to a secondary market for the value of retail liquor licenses. Because the moratorium is set to expire in less than three years, we do not see licenses building significant value in Tennessee.

10% Markup on Spirits. P.C. 783 also imposed a 10% minimum markup on the price of spirits. The 10% markup parallels the provisions of the 20% markup, already in place for wine.

We see the 10% markup on spirits as a first step toward legalizing the sale of spirits in food stores. Note to Consumers: don’t hold your breath. You are not going to be Krogering for vodka any time soon.

23-7. Our favorite legislative development in 2018 was a law that never came to pass. Serving liquor 23-7 stole the show during the 2017 legislative session. The Diner in downtown Nashville and Scoreboard Bar & Grill in Donelson passed special legislation that allows the restaurants to serve alcohol 23 hours a day, 7 days a week, beginning at 4 a.m. until 3 a.m.

After all the chatter in the industry about the unfairness of allowing two bars to serve late-night drunks, no one seemed interested in pursuing an expansion of the legislation in 2018. Perhaps the industry is wise enough to know that last call at 3 a.m. ain’t so bad.

The Legislature adjourning always reminds us of the popular David Bowie tune Modern Love:

Get’s me to the Church on Time

(Church on Time)

Terrifies me

(Church on Time)

Makes me party

(Church on Time)

Puts my trust in God and Man

Delivery. P.C. 765 paves the way for delivery of beer, wine and spirits by grocery delivery services such as InstaCart, Shipt, Post-Mates and ye olde mom and pop delivery service … Amazon. The new delivery law water’s down the requirements for drivers and generally makes licensing for delivery services significantly easier. Previously, only retail liquor stores and prepared food delivery services could deliver alcoholic beverages. P.C. 765 expands the scope of delivery services to include delivery of alcoholic beverages with groceries.

Instead of some form of responsible alcohol sale and age identification training, delivery service licensees only have to show that drivers are 21 or older, passed a background check indicating no felony convictions in the last 5 years, or any crime involving the sale or distribution of alcohol within the past seven years, and hold a valid driver’s license. The delivery service license fee is based on the number of delivery drivers.

Perhaps most important is the provision allowing independent contractors to deliver. This allows an Uber-type arrangement, where random drivers respond to internet delivery services to rush alcohol to someone’s home.

Under prior law, customers could order alcoholic beverages through apps such as Drizy, but delivery was made by employees of retail liquor stores that are trained as certified clerks.

P.C. 933 requires that delivery services only deliver to the physical address placed with the original order. Although delivery can only be made after checking the recipient’s age, there is no requirement that the delivery be made to the person that originally placed the order. All you need is one 21-year-old with an ID to deliver alcohol to a bunch of minors at a party. And with untrained Uber-type drivers delivering orders …oh well, we digress.

Local Option. Under current law, only cities or towns with the population of more than 925 can authorize manufacturing, storage, distribution and sale of alcoholic beverages by local option. P.C. 692 and 891 create exceptions to the minimum 925 population, allowing Etheridge and Cedar Hill to hold referendums to allow on and off-premise retail liquor sales.

Storage. P.C. 933 specifies that retailers can only store beer on the premises where beer will be stored. Apparently, someone had the bright idea to sell-wholesale beer and to multiple stores, which is now prohibited.

Collegiate Sports. As the dog days of summer drag on, one thing continues to inch closer – football. Fans of Middle Tennessee State University and Tennessee State University should be particularly excited about the 2018 football season. P.C. 1010 clears the path for authorizing the sale of alcohol at MTSU and TSU sporting events.

Sneaking alcohol into school sporting events is a time-honored tradition for co-eds and adults alike. Universities are beginning to capitalize on the lucrative revenue stream available from the sale of alcohol, which was generally prohibited under the guise of student safety. Indeed, seven Power Five Conference Schools – Texas, West Virginia, Minnesota, Maryland, Syracuse, Miami and Louisville, already sell beer at home games.

Because Western Kentucky University, another USA Conference member, also allows alcohol sales at sporting events, MTSU should not have an issue with Conference approval. As of press time, there was insufficient information concerning whether TSU must first obtain approval from the Ohio Valley Conference. For all those Vol fans out there, the Southeastern Conference currently does not allow any school to sell alcohol at school-sponsored sporting events. P.C. 1010 only applies to facilities in Davidson and Rutherford counties.

Distilleries. P.C. 1027 clarified that samples served and beverages sold for consumption at the distillery are not subject to the 15% privileged tax. The legislation reverses an Attorney General Opinion finding that distiller’s retail sales are subject to the 15% privilege tax. The legislature clarified that aged whiskey barrels are not subject to property taxes, also overturning a Tennessee Attorney General opinion to the contrary. P.C. 717 expands storage options for distilleries, allowing distilleries to store in adjacent counties, as well as any county that is authorized manufacturing. P.C. 650 allows manufacturing in Lenoir City.

Premier Type Tourist Resorts. The following premier type tourist resorts were approved, allowing on-premises consumption of alcoholic beverages:

- Pine Creek Golf Course in Wilson County

- Capitol Theatre in Greeneville

- Gaylord Springs Golf Links in Nashville

- Whitestone Country Inn in Kingston

- National Museum of African American Music in Nashville (Opening 2019)

- The Church @ 117 in Coffee County

- Drafts and Watercrafts in Franklin County

- The Caverns in Grundy County

- South Jackson Civic Center in Tullahoma

- Tellico Village in Loudon County

- Wildwood Resort & Marina in Granville

- 1892 Restaurant in Williamson County

- Leipers Fork Market in Williamson County

- Marblegate Farms in Blount County

- Blue Mountain Mist Country Inn & Spa in Sevier County

- Amis Mill Eatery in Hawkins County

- Shelly Belle’s in Claiborne County

- Oasis Pizza Bar in Claiborne County

Special credit goes to our summer associate and UT law student James Nelson for all his hard work on this project.

Source: LastCall

0